By Vincenzo Giordano, Director – Sustainability Solutions for cities and communities, ENGIE Impact.

Port Trucking and Climate Change

Short-haul trucking at ports is a major contributor to global carbon and nitrogen oxide emissions. Port activities alone account for 3% of global carbon emissions and heavy-duty trucks emit around 40% of a port’s total greenhouse gases (GHGs).

These so-called drayage trucks complete routes within a 150-mile radius, transporting goods between two ports, between ports and distribution centers or warehouses and between nodal points within the same port. Although they travel relatively short distances, the frequent stops and starts—as well as spending idle time in queues with their diesel engines running—make them one of the most energy inefficient forms of transport.

Additionally, ports are often located near disadvantaged communities, meaning the immediate impact of their pollution falls disproportionately upon the marginalized. These environmental and social factors are driving a strategic need for deep decarbonization of ports and of truck fleets.

In this article, ENGIE Impact looks at the potential to transform the San Pedro Bay Ports’ 15,000 diesel drayage fleet to zero-emission trucks (ZE) by 2035. Drawing from our experience in large-scale energy infrastructure and eMobility transitions, we explore the opportunities that adopting as-a-Service models can provide to not only San Pedro Bay Ports (California), but ports around the world facing similar decarbonization challenges.

Ports: Air Quality and Sustainability in Focus

The Port of Los Angeles (PoLA) and the Port of Long Beach (PoLB), collectively the San Pedro Bay Ports (SPB Ports), is the busiest port system in the Western Hemisphere. As a leader in port sustainability, they have consistently reduced GHG emissions between 5% and 7% on a year-over-year basis and when compared to 2005, have reduced GHG emissions by 32%. They are also targeting local air pollutants such as sulfur oxide (SOx), nitrogen oxide (NOx) and ozone, which contribute to $44 million per year in health care costs in Los Angeles related to respiratory hospitalizations.

However, to fully address their local air quality and global climate impacts, the SPB Ports have pledged to achieve 100% zero-emission (ZE) Class 8 truck operations by 2035. Their Clean Truck Zero Emission Funding Program will be instrumental to achieving their ambitions.

The SPB Ports currently use a diverse network of over 15,000 drayage trucks, populated by both large corporate-owned fleets and small owner-operators. All operators are essential community members, some of whom may need extra support to meet emission reduction targets.

Encouragingly, these initiatives enjoy strong political support from federal, state and city bodies.

In 2020, California introduced the Advanced Clean Trucks (ACT) rule, which mandates that an increasing percentage of state-wide freight truck sales be zero emission trucks, beginning in 2024. Similar measures have followed nationwide. Fifteen Northeast states and the District of Columbia, for instance, recently signed the Multi-State Medium- and Heavy-Duty Zero Emission Vehicle Memorandum of Understanding, with similar goals to decarbonize truck fleets. Meanwhile, large port cities across the globe are proactively introducing their own measures.

Obstacles to Truck Fleet Electrification

While these policy actions are steps in the right direction, the path to implementation on a meaningful scale faces financial, infrastructure and operational barriers. In order to understand these challenges on a deeper level, ENGIE Impact undertook an analysis specific to the drayage fleets—both large and small—operating at the SPB Ports. Here’s what we found:

- High total cost of ownership (TCO)

In 2021, the estimated TCO for heavy-duty electric trucks is 30-35% higher when compared to diesel trucks. For small scale drayage operators, that number is 40-45%. This cost includes not just the initial purchase price of the vehicle, but routine maintenance, insurance, fuel costs, equipment replacements and eventual resale value.

- High upfront capital investment

Upfront capital and financing costs for heavy-duty electric trucks and supporting charging infrastructure, range from $450,000 for large drayage operators to $550,000 for small operators. While we estimate significant electric truck price reductions to be achieved within the next decade, at 2021 prices an electric truck costs roughly double that of its diesel counterpart.

- Unproven technology

The availability of electric truck fleets on a commercial scale is a still-emerging innovation. While suppliers like Tesla are promising 500 miles with a single battery charge and per-mile operating costs $0.25 less than traditional diesel, electric trucks lack a track record to prove how those promises play out over their lifespan.

- Operational change

Southern California—like most of the world—does not have the necessary charging infrastructure in place to enable wide-scale electric vehicle (EV) uptake. Large and small trucking operators that transition to electric truck fleets will have to jointly invest in charging infrastructure, or enter contract arrangements with charging suppliers, adding further complexity and cost to an already significant transition.

- Complex stakeholder ecosystem

Short-haul truckers operate within a public and private stakeholder ecosystem that includes federal, state, regional and local governments, port agencies, community groups, logistics hubs, cargo owners, truck drivers and local utilities. While each group stands to benefit from the zero-emission transition, uncoordinated actions can leave red tape, misallocated costs and unaddressed risks that slow adoption.

Traditionally, governments and policymakers have overcome clean technology cost barriers with subsidies and fees designed to encourage adoption. However, direct incentives alone are likely inadequate to address the cost differential between electric trucks and diesel, the inequality between large and small operators, insufficient infrastructure and the complex technological risks.

As-a-Service Models can Accelerate Drayage Vehicle Decarbonization at Ports

Novel as-a-Service models provide a compelling solution to shift the zero-emission truck transition from small pilots to scaled deployments. As-as-Service models leverage public and private actors to lower costs, share risks and expand the capital available for zero-emission fleets. They allow drayage operators to maintain their core logistics businesses while introducing new partners to finance and manage emerging EV technologies and infrastructure.

Perhaps most importantly, these models offer disproportional benefits to small operators when compared to large operators. The former face higher TCOs in the transition to electric, due to the inability to capitalize on economies of scale and secure low-cost financing. When making the transition from diesel to electric, a smaller operator would require direct incentives 30%-40% higher than required by large operators. As-a-Service models, however, pass on the benefits of scaling to smaller operators, shaving 30%-40% more off their TCOs when compared to their larger counterparts.

Incorporating the financial, technical and political challenges that ports around the world face in their drive for carbon neutrality, we see two primary as-a-Service models for port ecosystems to transition drayage fleets. Both alternatives, if implemented, achieve drayage fleet decarbonization at a lower total cost and risk when compared to models where drayage operators are solely responsible for transitioning their fleets.

Two as-a-Service Models that Can Accelerate Zero Emission Truck Adoption

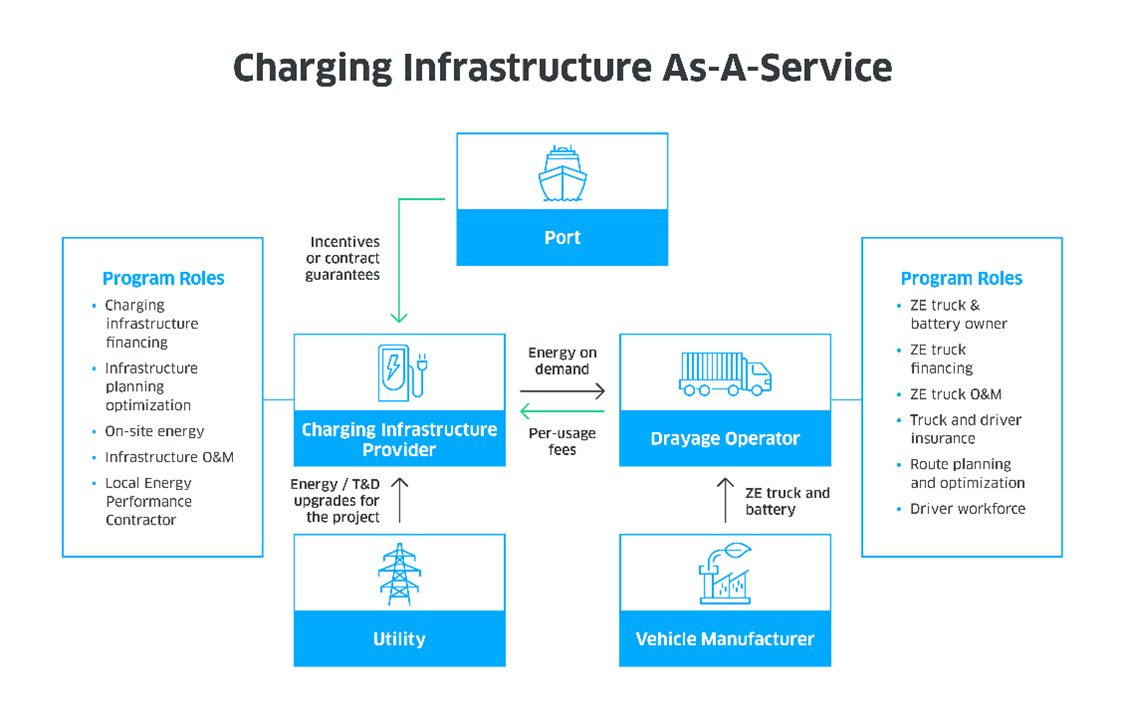

Model 1: Charging lnfrastructure as-a-Service (CIaaS)

In the CIaaS model, a central infrastructure provider designs, builds, operates, maintains and finances vehicle charging infrastructure for drayage operators—via public or private truck depots—and charges a fee per kilowatt-hour (kWh). Drayage operators enter an as-a-Service contract with the infrastructure provider to pay for the electricity used to power their daily operations, while maintaining ownership of the zero emission trucks as well as cargo logistics and transport.

A dedicated entity assumes the risks associated with maintaining charging infrastructure, thus, easing the operational burden on drayage operators large and small. The central entity manages permitting, installation, purchasing process and all ongoing operational and maintenance issues over the infrastructure’s lifespan.

Benefit: Experienced infrastructure providers reduce risk and cost of capital

Having an experienced, scaled charging provider that can access reduced financing rates and cheaper equipment also reduces costs. Our estimates for the SPB Ports found this arrangement could reduce zero-emission truck TCO costs by 4%-8% for small operators and 1%-4% for large operators. Further, drayage fleets could reduce upfront capital and financing costs by $65,000-$90,000 in the case of small operators and $40,000-$50,000 in the case of large operators between 2020 and 2035.

Benefit: Lower costs reduce time to cost parity

These lower costs also move up the time when zero emission trucks will become less expensive than diesel trucks. Estimated cost parity could be achieved one to two years sooner for overnight charging solutions and up to five years sooner for fast charging solutions. There is a disproportionate benefit for accelerating cost parity for fast charging, which will enable two-shift drayage operators to convert to zero emission drayage vehicles on an accelerated timeline.

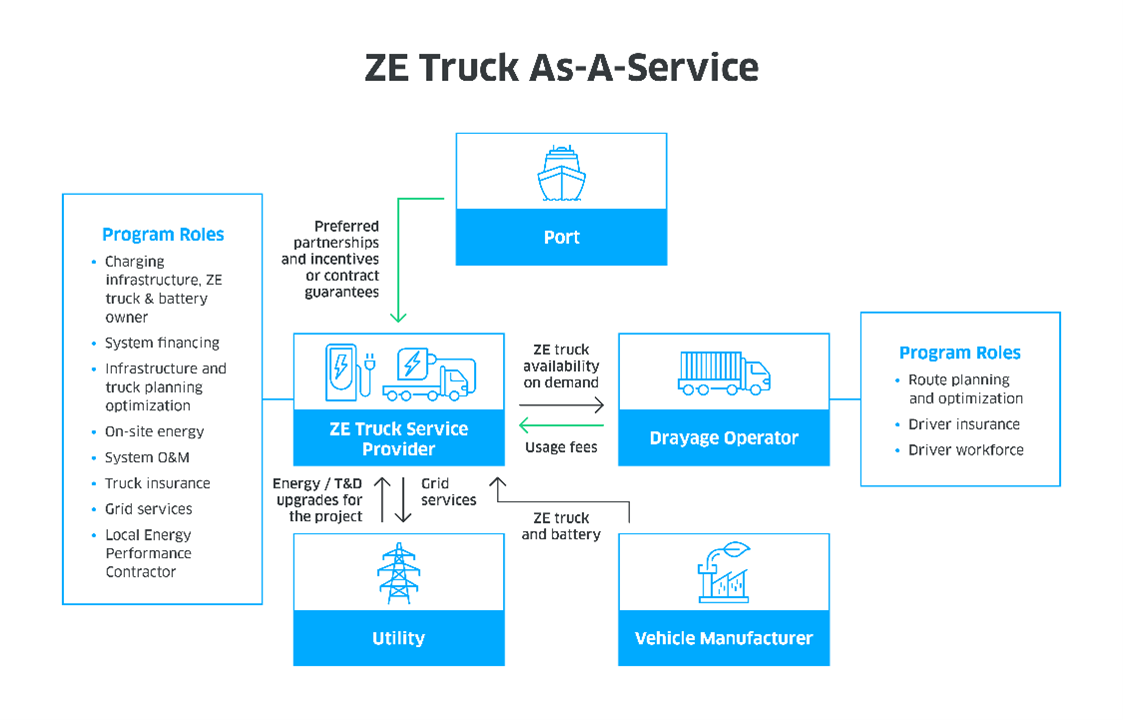

Model 2: Zero Emission Truck as-a-Service (ZETaaS)

In the ZETaaS model, a central zero emission truck service provider finances, owns and maintains both the charging infrastructure and the zero emission drayage vehicles in a centralized fleet. Drayage operators then pay the zero-emission truck service provider for truck availability as they require it, much like a car rental service. In this way, the responsibility for truck and infrastructure capital assets are consolidated under one provider. That includes maintenance, upgrades and end-of-life turnover. The truck service provider ensures truck availability on a per mile, hour, or TEU basis, while drayage operators retain ownership and management of cargo and logistics transport.

With a central entity, the operational burden of both charging infrastructure and zero emission drayage vehicles is eased since the entity can implement widespread fleet management policies in a coordinated manner. This might include route management to maximize range of zero emission drayage vehicles and fuelling coordination to minimize demand charges and leverage maximum incentives.

Benefit: Transferring both infrastructure and truck asset ownership unlocks greater cost savings and accelerates time to cost parity

Transferring infrastructure and vehicle ownership to a central entity reduces both the upfront cost of zero emission drayage vehicles and the operational costs. Our estimates found that this arrangement could reduce zero emission truck total cost of ownership (TCO) by 15%-20% for small operators and by 5%-8% for large operators. Upfront capital and financing costs for drayage operators could be reduced by $235,000-$550,000 for small operators and by $200,000-$450,000 for larger operators, between 2020 and 2035. The resulting reduction in cost can accelerate estimated cost parity with diesel by three to seven years for small operators and two to three years for larger operators.

How port agencies can accelerate adoption of as-a-Service models

To adopt zero emission heavy-duty trucks quickly and economically, port agencies and drayage fleet operators need innovative models that address the technological, financial and complex implementation challenges. As-a-Service models offer an attractive solution. As outlined, these models can significantly lower the total cost of ownership and accelerate timelines to cost parity, with an equitable transition made accessible to small and large drayage operators alike.

Port agencies will play a critical role in this transition. While they are not the direct owners of some of the biggest port emitters—heavy-duty truck fleets and cargo ships—as-a-Service models provide an avenue for port agencies to innovate and create incentives for such models to grow. They can do so in the following ways:

- Administratively, port agencies would be important program advocates, encouraging operators to join the programs and vetting preferred as-a-Service providers.

- Operationally, port agencies support the permitting and planning required to build-out charging infrastructure at scale.

- Financially, they can structure innovative incentives to encourage early adoption, mitigating the initial cost gap and program risks as ZETs achieve scale.

As the players within the port ecosystem unify behind the shared goal of decarbonization, collaboration will be critical to unlock progress. Together, stakeholders can deploy proven solutions at a scale that reduces overall cost and risk, a necessary step to meet ambitious climate goals.

ENGIE Impact delivers sustainability and decarbonization solutions for port districts around the world. ENGIE Impact brings together a wide range of strategic and technical capabilities, to provide a comprehensive offer to support clients in tackling their complex sustainability challenges from strategy to execution. With 21 offices worldwide and headquarters in New York City, ENGIE Impact today has a portfolio of 1,000 clients, including 25% of the Fortune 500 Companies, across more than 1,000,000 sites.